Office market insights for Germany's top 7 cities in 2023

The office property market in the seven most important German cities - Berlin, Düsseldorf, Frankfurt, Hamburg, Cologne, Munich and Stuttgart - will show interesting developments in 2023, presenting both challenges and opportunities for investors, landlords and tenants. The German Property Partners (GPP) Market Report 2023 provides a detailed insight into the performance and trends of these locations. Current office market trends and developments in office letting, rents and the investment market in Germany are discussed below. A central aspect of the article is the key figures relating to vacancies in square metres and vacancy rates in Germany, as well as the challenges and opportunities for tackling vacancies.

Current trends and developments in office letting

In 2023, the German office market will show relevant trends and developments that offer both challenges and opportunities for investors, landlords and tenants. In the seven most important locations in Germany, take-up totalled 2.4 million m², which corresponds to a 31 % decline compared to the previous year. Take-up refers to the total amount of office space that was newly let or extended in a market area in a given period and provides information on the demand for office space and activity on the office market. This development is due to the weaker economy and the lack of major deals.

Another striking development is the significant increase in the vacancy rate to 6.1 %, which is attributable to the increasing use of home offices and flexible working time models. The vacancy rate is the percentage of unused or vacant office space in relation to the total office space stock in a particular market area. Despite this increase, letting prices remain stable and prime rents have even risen in many cities, reflecting the continuing demand for well-equipped office space in premium locations.

In the area of office property investments, there was a significant decline in the transaction volume, which stood at €7.9 billion in 2023, a decrease of 69 % compared to the previous year. A completion of 1,751,800 square metres of office space is expected for 2024, with a pre-letting rate of 61 %. These figures indicate stable demand and a healthy level of confidence in the market, and meanwhile speak in favour of future growth in the office market.

Rental price comparison and investment market in Germany

Office rents in the top 7 locations remained robust, with prime rents, i.e. the highest rents achieved per square metre for office space in the best locations and highest-quality buildings in a market, rising on average. The front-runner is Munich with a prime rent of €52.30 per square metre, followed by Frankfurt at €47.00 and Düsseldorf at €44.30 per square metre. These price developments reflect the high demand for first-class office space despite increased vacancy rates.

The investment market for office properties recorded a significantly lower transaction volume of €7.9 billion, which corresponds to a decline of 69 % compared to the previous year. Despite this decline, the office property market remains the strongest asset class with a share of 51 %. Prime yields for office properties rose across all locations to an average of 4.34 %, significantly higher than in the previous year. This shows that investors continue to have confidence in the German office property market despite the lower transaction volume.

Vacancy and vacancy rate: analysis and need for action

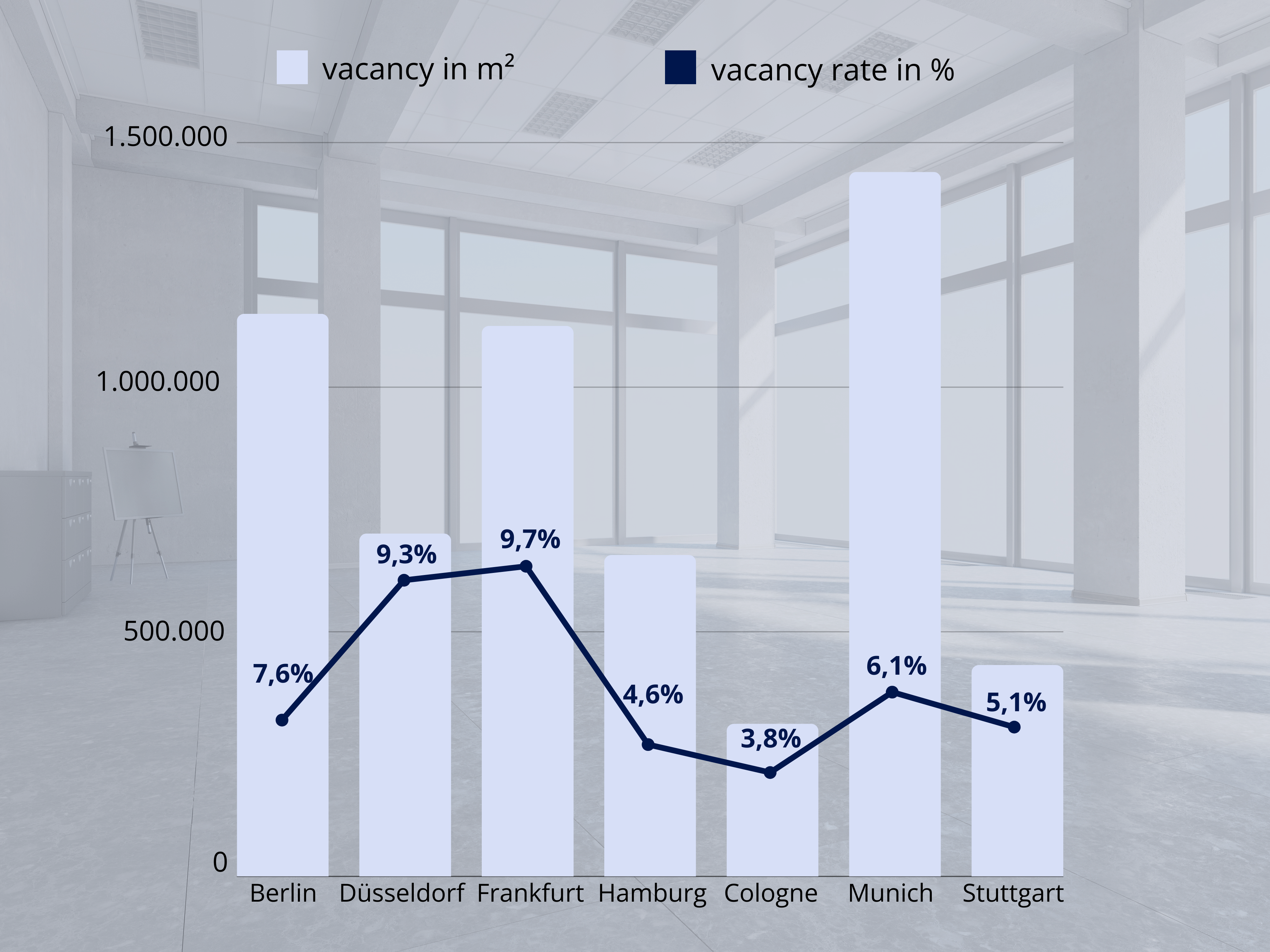

The following chart provides a detailed overview of the vacancy rate and the vacancy rate of the top 7 office markets in Germany. The vacancy rate provides information on the current utilisation and supply of office space and is an important indicator of the state of the office market. In the top 7 locations, it has risen to a total of 6.1 %, 1.0 percentage points more than in the previous year.

Source: German Property Partners (GPP)

Berlin has a significant vacancy rate of around 1,100,000 square metres and the vacancy rate is in the middle range at 7.6 %. This indicates a sufficient supply of office space, although there is still room for additional demand.

In Düsseldorf, the vacancy rate is around 700,000 square metres and the vacancy rate is 9.3 %. This is one of the highest values among the top 7 locations in Germany and indicates an oversupply or lower demand.

Frankfurt has a similar vacancy rate to Berlin, but with a slightly higher vacancy rate of 9.7 %. This may indicate greater difficulties in letting existing office space, possibly due to high supply or specific market conditions.

Hamburg has a vacancy rate of around 600,000 square metres and one of the lowest vacancy rates at 4.6 %, implying a highly sought-after office market in which vacant space is quickly taken up.

At around 400,000 square metres, Cologne has the lowest vacancy rate and, at 3.8 percent, the lowest vacancy rate of the locations surveyed. This indicates a very tight market with high demand and limited supply.

In Munich, the vacancy rate is around 1,400,000 square metres, which is the highest absolute figure compared to the other locations. At 6.1 %, the vacancy rate is in the mid-range and shows a balanced market situation despite the high absolute volume.

Stuttgart has the lowest vacancy rate with around 300,000 square metres and a vacancy rate of 5.1 %. These key figures indicate a relatively stable market with moderate demand and available supply.

The high vacancy rates in some of the top 7 locations show that there is a need for action to utilise the available space more efficiently. With our ShareYourSpace platform, we offer a targeted solution that enables vacant office space to be let and booked flexibly. This can help to reduce vacancies and promote a more sustainable use of office space. In cities with high vacancy rates, landlords and investors should consider efficient solutions to better market the space and adapt it to the changing needs of tenants.

Outlook and perspectives

The office market in the top 7 locations in Germany will show a mixed performance in 2023. While the vacancy rate has risen, prime rents remain robust and the pre-letting rates for 2024 are promising and indicate healthy interest and confidence in the office property market. Efficient solutions for renting and booking office space and workspaces, such as our ShareYourSpace platform, can reduce vacancies and make the market more flexible and sustainable. Investors and landlords should keep a close eye on developments in order to exploit opportunities and minimise risks.

Analyses by German Property Partners clearly show that, despite the challenges posed by the economic situation and changing working conditions, demand for high-quality office space in prime locations remains unabated. Companies that own unused office space can use platforms such as ShareYourSpace to rent it out efficiently and thus reduce vacancy rates. This not only helps to reduce costs, but also promotes sustainability by optimising the use of existing resources.

Another perspective is the growing importance of flexibility and adaptability in the office market. At a time when hybrid working models and working from home are becoming increasingly important, office space must not only be of high quality but also flexible to use. ShareYourSpace offers the opportunity to book or rent space at short notice and in line with demand. This meets the modern requirements of many companies that need to react quickly to changes.

Investors and landlords should also keep an eye on long-term trends, particularly the development of urban infrastructure and the increasing importance of sustainability. Cities that invest in sustainable infrastructure and environmentally friendly construction projects could become even more attractive to companies that value corporate social responsibility in the future.

Other articles you might find interesting:

- Climate Protection and Climate Targets in the Building Sector in Germany

- Rise of the Sharing Economy: A Revolution in Sharing

- Shared Office: The Flexible Office Concept